WHAT IS ‘PROFIT PER X’ (AND WHY IS IT POWERFUL?)

Here’s a deceptively simple question. What type of business are you really in? Do you know where your profit comes from? Transactions? Memberships? Events? Sometimes the answer isn’t as obvious as it seems.

Take the example of Sat Singh, the owner of Autopia car wash. His lightbulb moment came when he realised the true value of customers who paid for his car wash memberships. Up until this point, he’d seen them as an inconvenience. They took up more admin time to update credit card details than his single-transaction customers.

But when he crunched the numbers in his business, he realised these customers were ten times more valuable. That’s massive! Once he realised this, he re-modelled his company to focus on memberships, making customer satisfaction and member benefits central to his strategy. Profit per membership card became his new profit per x – the one metric that drove his company’s growth. (Thanks to Doug Wicks, fellow Scaling Up coach, for sharing this story).

Profit per x has the power to be transformational. It’s about communicating clearly to your organisation how you make money. And if this solves a constraint in your industry, it can become the secret sauce that will pull you away from your competition.

Where did profit per x originate?

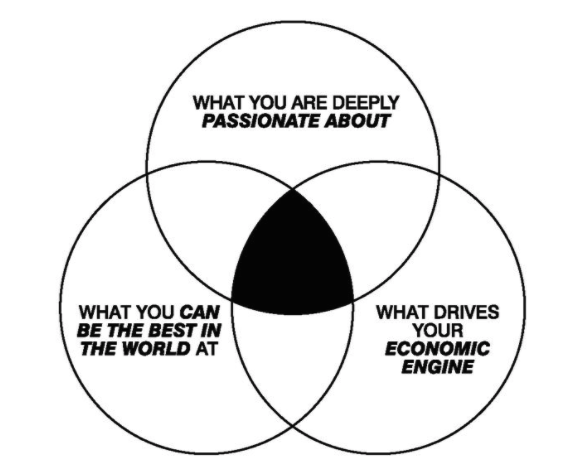

Profit per x is an element of strategy from Jim Collins’ book, ‘Good to Great’. It’s one of the three golden circles of his ‘Hedgehog Concept’ – something I refer to over and over with my clients. He believes that a successful strategy is formed from overlapping 1) What you are deeply passionate about (your ‘Why’) with 2) what you can be best at in the world and 3) what best drives your economic engine.

Collins explained that each of the ‘great’ companies he studied had a deep understanding of the key drivers in its economic engine and built its system accordingly. He said, ‘If you could pick one and only one ratio – profit per x – to systematically increase over time, what x would have the greatest and most sustainable impact on your economic engine?’ This single question can lead you to profound insights into the inner workings of your company’s economics.

Why is profit per x powerful?

Knowing your profit per x can be transformational to the way you run your business. Here are the main reasons why:

– Enables the right decisions

Look back on the decisions you made last year to spend money – products you’ve launched, people you’ve hired etc. Were all of those decisions guided by asking how they maximise your profit per x? Lots of companies sell widgets and have a gross profit expectation of the things that they sell. Nothing wrong with this. It can guide revenue or margin targets for sales teams. The emphasis is likely to be on limiting discounts to maintain margin. But what if there was another way of looking at it?

Take McDonald’s and its supersizing policy. Customers could ‘go large’ for 50c. There’s very little margin in this – if they were focusing purely on profit per portion of fries, the increase in margin would be tiny. But the focus of the fast-food giant was on maximising profit per customer visit. By driving up the value of the customer experience, it was ok to lose on margin because they were serving millions of people every day all over the world.

This drove key decisions in their business. They were all about convenience – self-service, drive through, fewer staff to serve the same volume of customers etc

– Changes your focus

Who else applied this playbook? Starbucks immediately springs to mind. Famously, they have a store every four blocks because many of their customers are on foot. By looking at profit per customer visit, they focused not only on selling coffee but other extras. Customers queue in front of tempting pastries and cookies to maximise each visit.

Jim Collins uses the example of Walgreens chemists in his book. Instead of focusing on profit per store, as their competitors were doing, they followed the McDonald’s/Starbucks model and applied it to their pharmacy business. Their purpose was convenience so they adopted profit per customer visit. This led them to focus on opening lots of smaller stores instead of a few big ones. And this increased the likelihood that people coming to one of their stores (because it’s conveniently located) would spend more money each time they visited.

– Differentiates you from your competition

When I took over as UK MD of Rackspace, our competitors were telcos who saw service as a cost, not a profit centre. We took a different approach. Our profit per x was profit per recurring revenue client and this led to a relentless focus on service – or ‘Fanatical Support®’ as we called it.

Our customer life-time-value was going up all the time as a result of the great service we provided. We measured our profit per x daily – it became the single metric that drove our growth. Our competitors were selling hardware or professional services. We didn’t give a sh*t about these things because they didn’t impact our profit per x.

Similarly, at Peer 1 our focus on profit per x led us to analyse our customer base. We realised our $10K a month customers were growing at 4% month on month. 5% of our customers represented 60% of our revenue. But we were only servicing them with 6% of our customer experience team. As a result, we were over-servicing 12,500 smaller clients and making barely any money from them. If they all churned, we’d be only marginally worse off. This understanding of our economic model led to a big re-structure to focus the majority of our resources on our higher value, larger customers. And exponential growth followed.

– Leads to different priorities

Switching to a new profit per x has led to a shift in priorities for many businesses. Take NetSuite. Before they were bought by Oracle, they used to run consulting and software as two profit lines. But after the acquisition, Larry Ellison changed their priority. He didn’t care about consultancy – its job was purely to drive recurring revenue.

It’s the same for hosting companies who’ve transitioned to cloud. They will do £100K of consulting but they’re more interested in the profit that comes off the back of that. They make enough on the project for it to be worth their while and are price competitive. But the real prize is the attach rate of the recurring revenue that this drives.

– Drives growth

Clients come to me to help them scale their businesses. One of our first conversations during kick-off revolves around profit per x. Often, it’s the first time they’ve thought about it. Their default way of thinking is gross profit per FTE. Sure, this will show that they’re becoming more efficient over time. But if they’re growing fast, I don’t feel there’s a requirement to become more efficient in the short term. As long as they can prove they can scale. This uses up valuable management cycles and energy that they could spend on growing faster. Instead, I guide them to find a profit per x that drives revenue growth.

There’s no doubt it was profit per x that led to Apple’s recent stratospheric growth in their market cap. They went from profit per item sold through profit per customer to finally arrive at profit per subscription. It’s the latter that’s led to a doubling in their valuation from $1 to $2 trillion in the past two years.

Similarly, Microsoft started out in the widget business selling windows server software and then moved to become a subscription business. They realised that for every dollar they made selling windows server licenses, they could make $7 – $14 if that customer moved to their cloud computing platform, Azure.

– Brings clarity

Companies struggle to find their profit per x when they’re not clear on their core customer and marketplace. Going back to the Hedgehog Concept. Profit per x is only one part of the equation. Equally important is what are you’re going to be the best in the world at. And for that, you need to know your core customer. Many companies have multiple core customers. They’re not really clear what problem they’re solving and for whom.

Take Southwest Airlines – the most profitable airline in the world. They worked out their core customer was a bloke who would otherwise get the bus or drive. They weren’t solving the problem of a Fortune 1000 executive who needs to fly from the US to Europe on a flatbed. It would have been dead easy for them to say, we’re in the airline business and we’re solving all of these problems for all these different customers.

Instead, they were clear on their customer and their profit per x was profit per aeroplane. They made their money whilst their planes were in the air. When they looked at their competitors, they weren’t looking at other airlines. They were bus companies. So, they designed their no-frills business around price – stripping out food, first-class, assigned seats, hold luggage etc. And they designed a highly profitable business as a result.

– Changes your industry

If you can solve a constraint in your industry, even better. This could be by stripping out a profitable cohort of customers and saying we can solve this problem for you and eliminate this restraint. The results can be transformational.

It was the game-changer at Rackspace. By seeing service as a profit centre, we took our highest value customer cohort – the ones that cared more about service – and charged them for a five-star experience. And they grew exponentially. This differentiated us from our telco competition – they couldn’t understand why we were growing at such a rate. But our relentless focus on churn and providing Fanatical Support meant the business scaled fast.

The razor market is another great example. Bic and Gillette started out making profit per widget, in this case, disposable razors. Bic is still in this space but Gillette realised quickly that a small group of customers were prepared to pay more for better quality razors. So they developed the Gillette marks 1, 2, 3 and 4. Their focus had shifted to looking at profit per customer.

Then along came the Dollar Shave Club who shifted again to a membership-based business. They told their customers, you don’t need to buy expensive razors – they’re a rip-off! Instead sign-up to our service and we’ll provide you with everything you need on a monthly basis. And the more you buy, the more you save with built-in discounts. Everything’s modelled around keeping customers for a long time. This meant they could drastically cut their marketing costs in comparison to Gillette, driving viral marketing instead. And this meant even more profit from their customers over the long term.

You can find more lessons from the works of Jim Collins in the post 7 important lessons from Jim Collins’ ‘Good to Great’.

Author: Dominic Monkhouse

Author: Dominic Monkhouse

- REFINE LEADERSHIP SKILLS

- STRATEGIC DIRECTION

- GREAT PLACE TO WORK

- EXECUTION FOCUS

- TRANSFORMATIONAL CHANGE

- EXIT READY BUSINESS

Written by business growth coach Dominic Monkhouse. Find out more about his work here. Read his book, ‘F**k Plan B’ here.