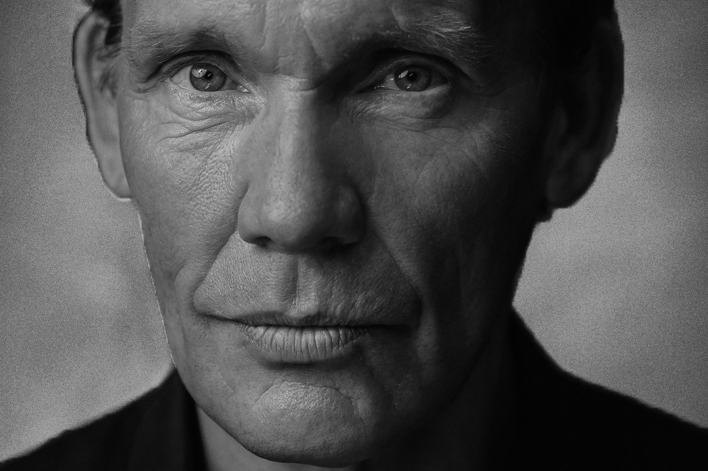

If you’ve ever suffered with your supply chain, then don’t miss Justin Floyd, founder and CEO of RedCloud, the startup looking to solve the distribution problem for B2B merchants and consumers outside of the Western world.

They’ve already run a trial in Argentina, and put an e-commerce or a digital distribution platform, trading platform and finance platform in the hands of physical stores in Southeast Asia, South America and Africa.

This is a truly fascinating conversation about Justin’s product and the problem they’re trying to solve. Because some of the parallels they’re tackling are currently challenging the UK, namely, tracking qualitative, consumer data.

Justin’s got an incredible track record: 25 years of building technology startups, he spent some time in Silicon Valley and some time in Cambridge. He’s run companies, he’s built companies, he’s sold companies, he’s invested in companies. All of which makes for a fascinating conversation.

“The world that I operate in, it’s got a product distribution problem. I mean, last year, there were just under $2 trillion worth of products that weren’t available in store for customers who wanted to buy them, because there is such little ability to be able to successfully distribute at scale.”

We really enjoyed it, we hope you do too.

On today’s podcast:

- Global distribution problem

- The lack of qualitative data

- The local store conundrum

- RedCloud’s solution

- Justin’s hiring secret sauce

Links:

- Twitter – @Jfloyd_1

- LinkedIn – Justin Floyd

- Website – RedCloud, Justin Floyd

Tackling the World’s Distribution Problem with Justin Floyd

Justin Floyd founded RedCloud to solve one of humanity’s biggest problems: to grow global access to the world’s consumer products. He built RedCloud, the first open commerce platform to connect brands to merchants and enable the mass, low cost distribution of consumer goods through a single app anywhere in the world.

“I’m a serial entrepreneur in technology for the last three decades. And I’ve been involved with some really interesting businesses over that period of time, and built tech companies that run across the world. Businesses I’ve been involved in, they’ve raised over collectively $1.2 billion in capital to help them grow. And I’ve sat on both sides of the equation. I’ve sat in the garage and I built a company from scratch and I’ve also sat on the other side of the table as an investment company, so I’ve seen both sides of it.”

Global distribution problem

This makes Justin incredibly well placed to seek out the answer to distribution, something the rest of the world struggles with, but has only really become a challenge in the UK recently.

“The world that I operate in, it’s got a product distribution problem. I mean, last year, there were just under $2 trillion worth of products that weren’t available in store for customers who wanted to buy them, because there is such little ability to be able to successfully distribute at scale.”

When you look at Amazon, their set up is truly incredible, granted they don’t treat their sellers very well, but as an ecommerce company, they have nailed distribution.

“They know end to end, how to buy, sell, distribute products and do that super efficiently, across multiple different markets, all different, all kinds of different sizes of customers, different sizes of sellers.”

They’re brilliant at getting the right product to the right customer at the right time.

The lack of qualitative data

But, says Justin, there’s a $2 trillion inventory gap globally in local stores across the world where customers go, who need a product, one product, and it’s just not available – and they don’t have access to Amazon.

And it’s not available because no one along the whole chain – the distributor, the manufacturer, the merchant, has access to qualitative data.

“Across the world, over $19 trillion worth of payments are made between small merchants, their distributors and manufacturers, all made in cash or non digitally.”

The local store conundrum

The world outside of the UK, Europe and the US is a big one, says Justin. There are over 5 billion middle class consumers living across Africa, Latin America and Asia; while they’re digital savvy and love online shopping, the traditional way they buy is offline from their local store.

Everyone buys from traders and street hawkers and local stores. Business gets done on mobiles, in an offline environment. So the question is, how do manufacturers or merchants get your product in front of consumers when you don’t have many options to retail?

Ecommerce is fine, says Justin, if you want to pony up with Amazon, or another ecommerce site, but when 80% of people like to buy in person, you need to be able to capture those street traders, those local stores, and make sure they’ve got your product at the right place at the right time. But to do that is very difficult, because most of the data that’s available is rubbish.

“You got people using things like WhatsApp to do ordering. I mean, Cola in Nigeria, for example, I think they take something like about 2 million orders a day or something stupid on pieces of paper.”

So how does RedCloud take that paper and take it online for them?

RedCloud’s solution

“We built from scratch a payment infrastructure that covers over 100 different countries, a population of over 6 billion people and allows up to 300 million merchants to be able to easily use that payment infrastructure.”

A lot of the rest of the world don’t have a bank account, nor do they have a credit card. RedCloud users have a trading account via the app from which they can start trading instantly with brands. They can buy and sell products, and they can move money electronically using their trading account.

“That trading account is backed by multiple banks across different countries, but we do all the heavy lifting so that all merchants see is a really sexy cool little app that all they have to do is press a couple of buttons and they’ve got a payment checkout online. They can buy their goods online and pay for it online. Also, most importantly they can start to build up a really useful credit profile through it as well so they can have access to financing and things like that.”

They also get credit sales insights, merchant behaviour insights, and a much more efficient way of trading with their merchants that doesn’t cost them much.

“We’re solving a pretty massive problem, we believe could become a very big problem. And it’s increasing. But it’s also a very big opportunity. And it’s a huge opportunity for these small businesses.”

Justin’s hiring secret sauce

What has Justin learned over his 25 years in business?

“I think the three big ones: how to get hiring right. How to get the product market fit right. And how else to raise money. Those are the three things [that when they] come together, they go to work almost parallel constantly with each other.”

He’s learned that bringing the ‘big swinging hot shot’ from a company like Microsoft into a startup and paying them a ridiculous sum of money and thinking they’re going to solve your business problems, isn’t the answer.

“There’s a big difference between being in the boat in the middle of the ocean, and very calm seas, just basically pointing in the right direction and making sure it goes the right way. Versus being in the middle of a bloody force ten in a dingy.”